How AI is Helping with Decarbonization

The urgency to cut greenhouse gas emissions and transition to sustainable energy solutions has never been greater. Governments, corporations, and industries worldwide are committing to net-zero targets,

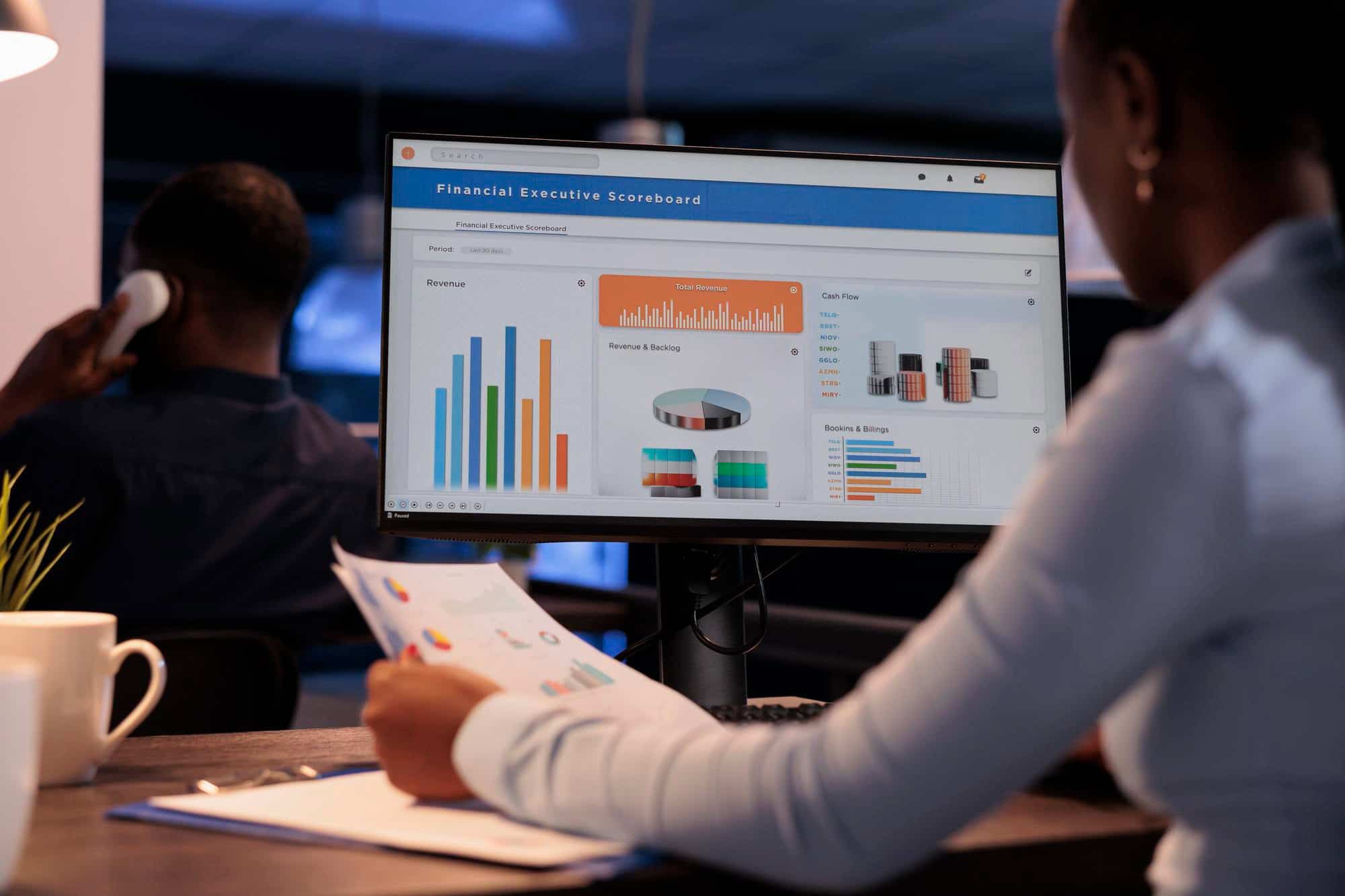

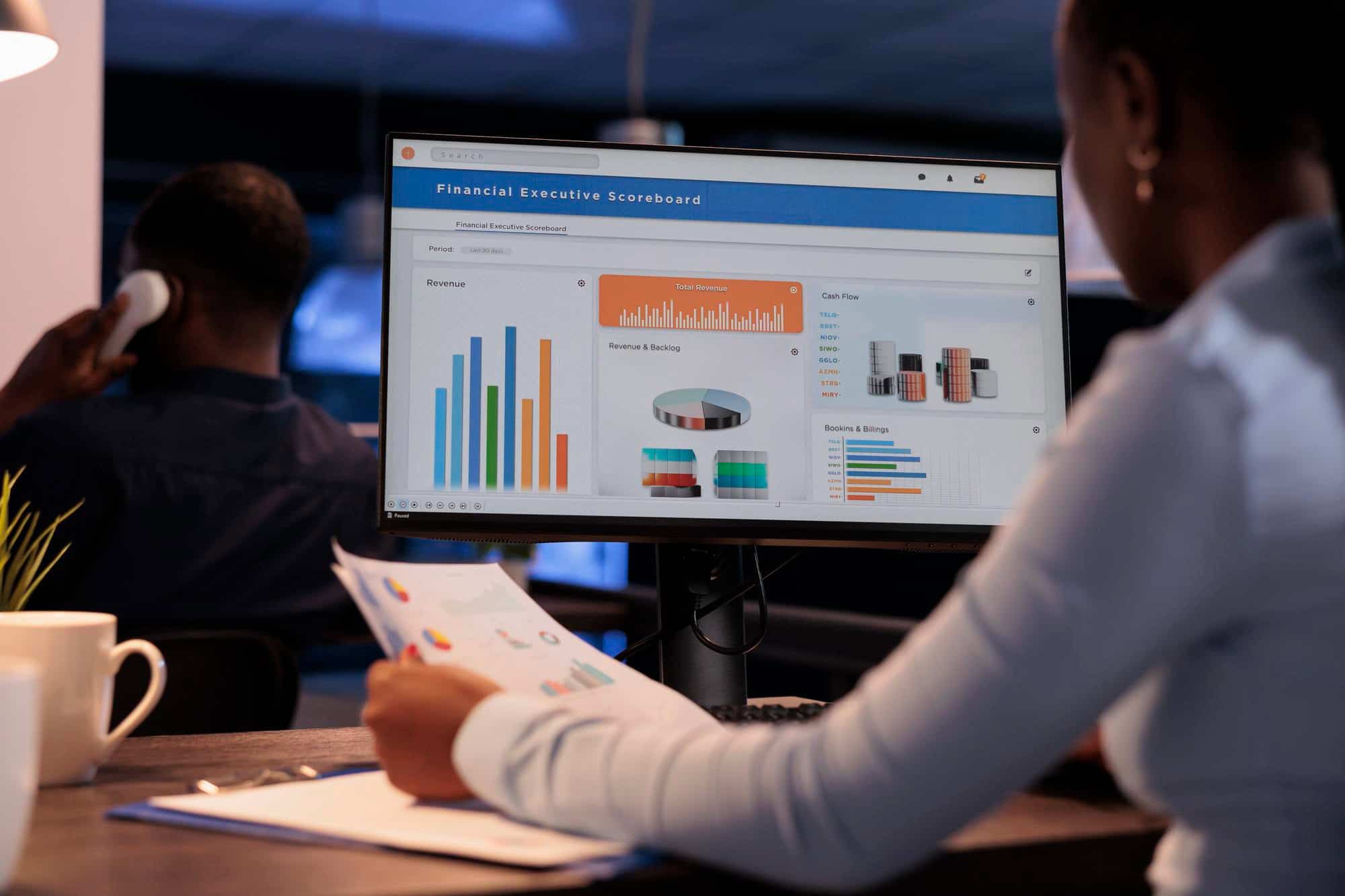

T+1 Settlement Transition: Challenges, Benefits, and the 2027 Roadmap

The global financial market is accelerating its shift to T+1 settlement, a move designed to enhance liquidity, reduce counterparty risk, and improve capital efficiency. While

Innovability: How BIP US is Revolutionizing Corporate Sustainable Innovation

Innovability, or sustainable innovation, is a strategic fusion of innovation and sustainability that is reshaping how companies tackle global challenges such as climate change and

T+1 Settlement Transition: Challenges, Benefits, and the 2027 Roadmap

The global financial market is accelerating its shift to T+1 settlement, a move designed to enhance liquidity, reduce counterparty risk, and improve capital efficiency. While

Innovability: How BIP US is Revolutionizing Corporate Sustainable Innovation

Innovability, or sustainable innovation, is a strategic fusion of innovation and sustainability that is reshaping how companies tackle global challenges such as climate change and

What's trending

Recent Innovations within Mobile Banking

Dating back to the early days of the stock market, investors would trade stocks with other investors in coffee shops. Many of these low to medium-net worth investors would purchase stocks on margin, which allowed them to borrow money from their shareholders and put down as little as ten percent of the share’s value. These investments were conducted with paper slips and were solely in-person interactions.

Fast Prototyping: the innovative approach to Digital Transformation

Benefits and advantages of fast prototyping for a successful digital strategy.

Other Insights

Gaming & recruiting: playing while finding a new job

An organisation’s population is the key to achieving objectives and obtaining results. This makes the recruitment process critical, so as to attract the right resources, at the right time and, most importantly, to the right roles. To be effective, this process should be flexible and permeable to market trends and to the motivations that drive new generations to choose a company as their employer. Such motivations are increasingly less linked to economic factors and more so to the vision the organisation is able to express.

Using Data Analytics to Improve Business Decision Making

Banking and financial service leaders face insurmountable business challenges that often require care, attention, nuanced thought, and insightful decision making. Data analytics can assist to tackle any business decision that requires prudent action. Whether trying to answer questions, detect trends, allocate capital, or extract insights, without proper data analytics, any decision maker is flying blind.

How Artificial Intelligence Is Improving Customer Service in the Financial Services industry

Artificial Intelligence (AI) is revolutionizing customer service in the banking industry and transforming how companies operate and interact with their customers, especially within the banking sector. AI-powered solutions allow companies to deliver personalized, efficient, and accurate service to their customers, ultimately leading to higher levels of customer satisfaction and loyalty. Through the use of chatbots, machine-learning algorithms, voice recognition technologies, and other advanced AI technologies, companies are enhancing their customer service capabilities in ways that were once unimaginable.

Recent Innovations within Mobile Banking

Dating back to the early days of the stock market, investors would trade stocks with other investors in coffee shops. Many of these low to medium-net worth investors would purchase stocks on margin, which allowed them to borrow money from their shareholders and put down as little as ten percent of the share’s value. These investments were conducted with paper slips and were solely in-person interactions.

How API’s Impact Payment Systems

As technology continues to advance, banking customers will increasingly require faster, more secure, and safer methods of payment. API (Application Programming Interface) is a software intermediary which allows applications to communicate with each other and plays an integral role within the banking technology ecosystem.

Gaming & recruiting: playing while finding a new job

An organisation’s population is the key to achieving objectives and obtaining results. This makes the recruitment process critical, so as to attract the right resources, at the right time and, most importantly, to the right roles. To be effective, this process should be flexible and permeable to market trends and to the motivations that drive new generations to choose a company as their employer. Such motivations are increasingly less linked to economic factors and more so to the vision the organisation is able to express.

Using Data Analytics to Improve Business Decision Making

Banking and financial service leaders face insurmountable business challenges that often require care, attention, nuanced thought, and insightful decision making. Data analytics can assist to tackle any business decision that requires prudent action. Whether trying to answer questions, detect trends, allocate capital, or extract insights, without proper data analytics, any decision maker is flying blind.

How Artificial Intelligence Is Improving Customer Service in the Financial Services industry

Artificial Intelligence (AI) is revolutionizing customer service in the banking industry and transforming how companies operate and interact with their customers, especially within the banking sector. AI-powered solutions allow companies to deliver personalized, efficient, and accurate service to their customers, ultimately leading to higher levels of customer satisfaction and loyalty. Through the use of chatbots, machine-learning algorithms, voice recognition technologies, and other advanced AI technologies, companies are enhancing their customer service capabilities in ways that were once unimaginable.

Recent Innovations within Mobile Banking

Dating back to the early days of the stock market, investors would trade stocks with other investors in coffee shops. Many of these low to medium-net worth investors would purchase stocks on margin, which allowed them to borrow money from their shareholders and put down as little as ten percent of the share’s value. These investments were conducted with paper slips and were solely in-person interactions.

Gaming & recruiting: playing while finding a new job

An organisation’s population is the key to achieving objectives and obtaining results. This makes the recruitment process critical, so as to attract the right resources, at the right time and, most importantly, to the right roles. To be effective, this process should be flexible and permeable to market trends and to the motivations that drive new generations to choose a company as their employer. Such motivations are increasingly less linked to economic factors and more so to the vision the organisation is able to express.

Using Data Analytics to Improve Business Decision Making

Banking and financial service leaders face insurmountable business challenges that often require care, attention, nuanced thought, and insightful decision making. Data analytics can assist to tackle any business decision that requires prudent action. Whether trying to answer questions, detect trends, allocate capital, or extract insights, without proper data analytics, any decision maker is flying blind.

How Artificial Intelligence Is Improving Customer Service in the Financial Services industry

Artificial Intelligence (AI) is revolutionizing customer service in the banking industry and transforming how companies operate and interact with their customers, especially within the banking sector. AI-powered solutions allow companies to deliver personalized, efficient, and accurate service to their customers, ultimately leading to higher levels of customer satisfaction and loyalty. Through the use of chatbots, machine-learning algorithms, voice recognition technologies, and other advanced AI technologies, companies are enhancing their customer service capabilities in ways that were once unimaginable.

Recent Innovations within Mobile Banking

Dating back to the early days of the stock market, investors would trade stocks with other investors in coffee shops. Many of these low to medium-net worth investors would purchase stocks on margin, which allowed them to borrow money from their shareholders and put down as little as ten percent of the share’s value. These investments were conducted with paper slips and were solely in-person interactions.