Exploring the New Mandate: How the Push for Central Clearing for US Treasury Markets Aims to Enhance Transparency, Reduce Risk and Reshape Banking Operations

Last Updated: February 28, 2025

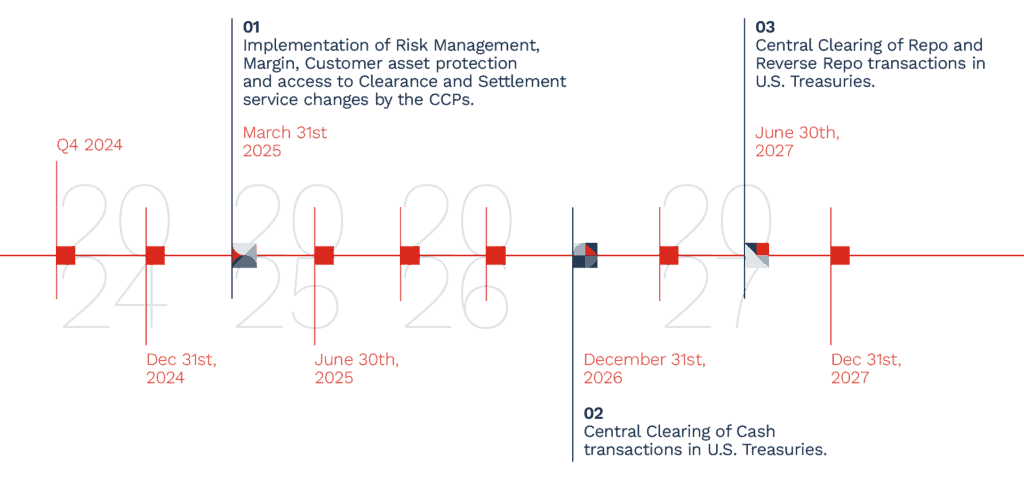

This insight has been updated to reflect the recent announcement by the SEC on Feb 25, 2025 to extend the compliance dates and provide temporary exemption for rules related to clearing of U.S. Treasury Securities.

SEC’s Recent Changes to the U.S. Treasury Clearing Mandate8,9:

- Compliance Deadline:

- Previously set for December 31, 2025, the new deadline is now December 31, 2026 for eligible cash market transactions.

- Previously set for June 30, 2026, the new deadline is now June 30, 2027 for eligible repo market transactions.

- Requirement: CCAs must ensure that direct participants submit all eligible secondary market U.S. Treasury transactions for clearing and settlement.

- Previously set for March 31, 2025, CCAs are not required to enforce policies and procedures regarding the separate calculation, collection and holding of margin amounts for proprietary positions until the new deadline of September 30, 2025.

- Impact: CCAs are temporarily exempt from enforcing these margin rules but may choose to do so for participants ready to comply.

The SEC has noted the extension provides more time for operational changes and risk management adjustments, ensuring smoother implementation of the new rules.

On December 13th, 2023, the U.S. Securities Exchange Commission (SEC) announced a landmark mandate for central clearing that will fundamentally reshape the U.S. Treasury market. Under this new rule, central clearing will be required for certain U.S. Treasury cash purchases and repurchase / reverse repurchase agreements “repo” through a Covered Clearing Agency (CCA). This will enhance the market’s fundamental strengths of safety and liquidity during periods of stress by minimizing counterparty credit risk; with impacts on established market practices across key segments including1:

- Treasury repo and reverse repo markets, affecting short-term liquidity instruments.

- Principal trading firms’ electronic cash trading, reshaping automated trading flows.

- Inter-dealer broker transactions, which historically relied on bilateral clearing.

- Transactions between direct Central Counterparty (CCP) members and registered broker-dealers, enforcing greater market discipline.

The Expanding Role of Central Clearing: What’s at Stake?

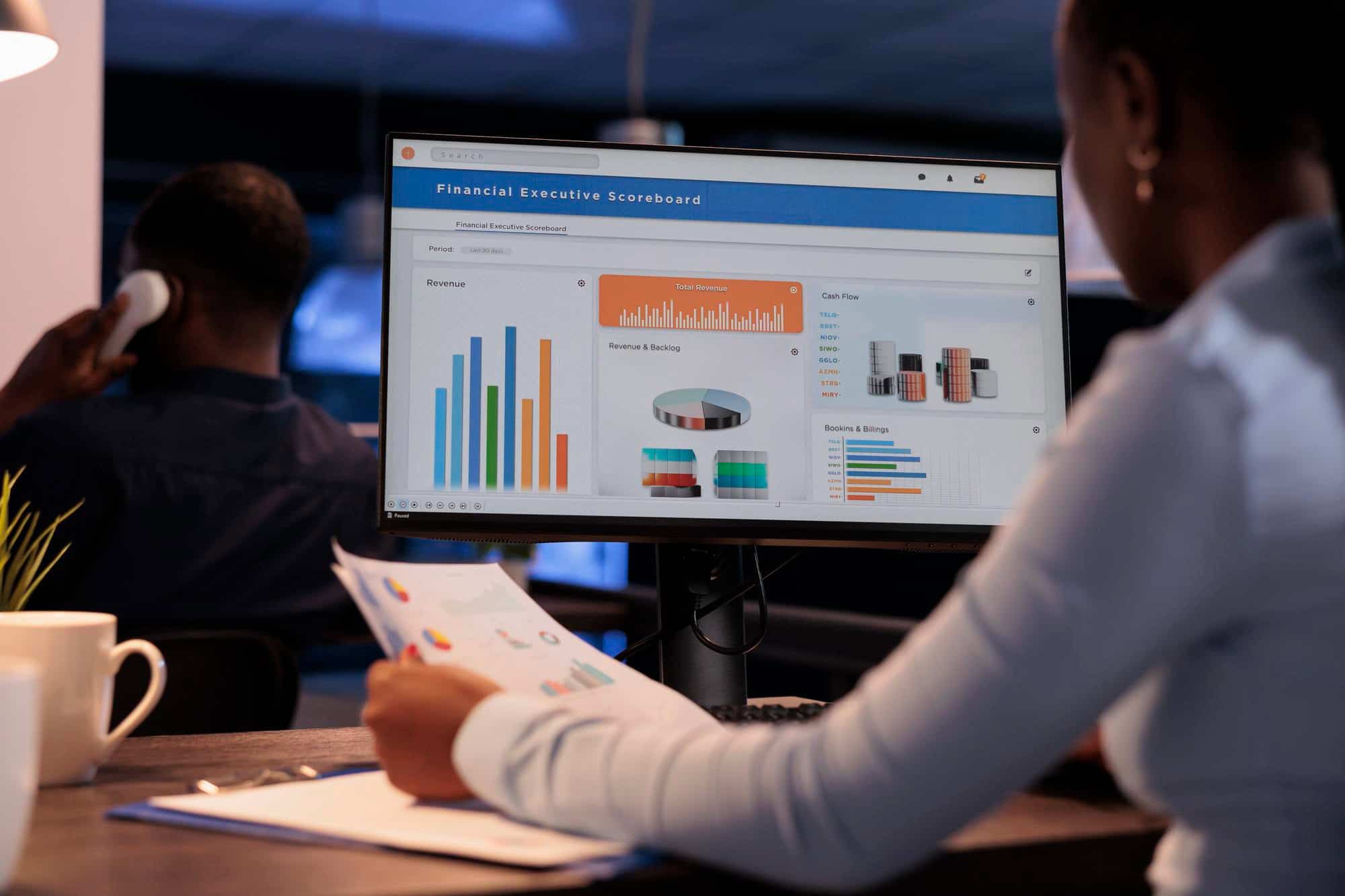

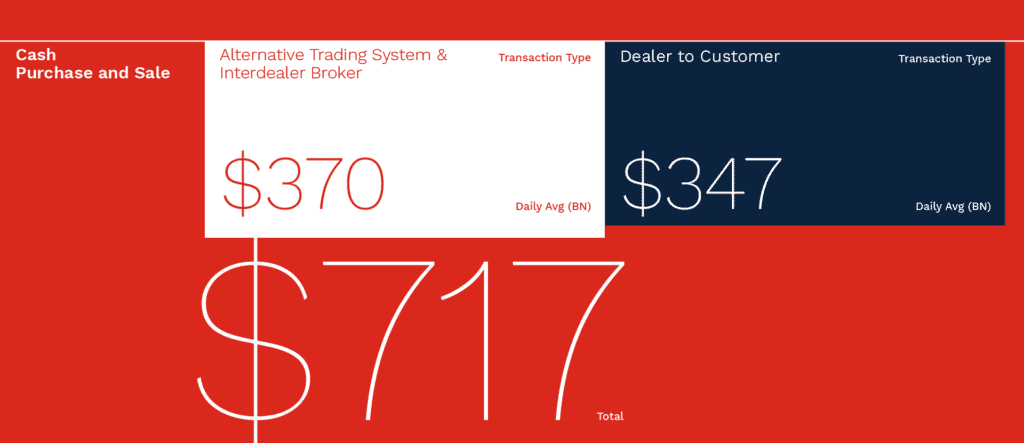

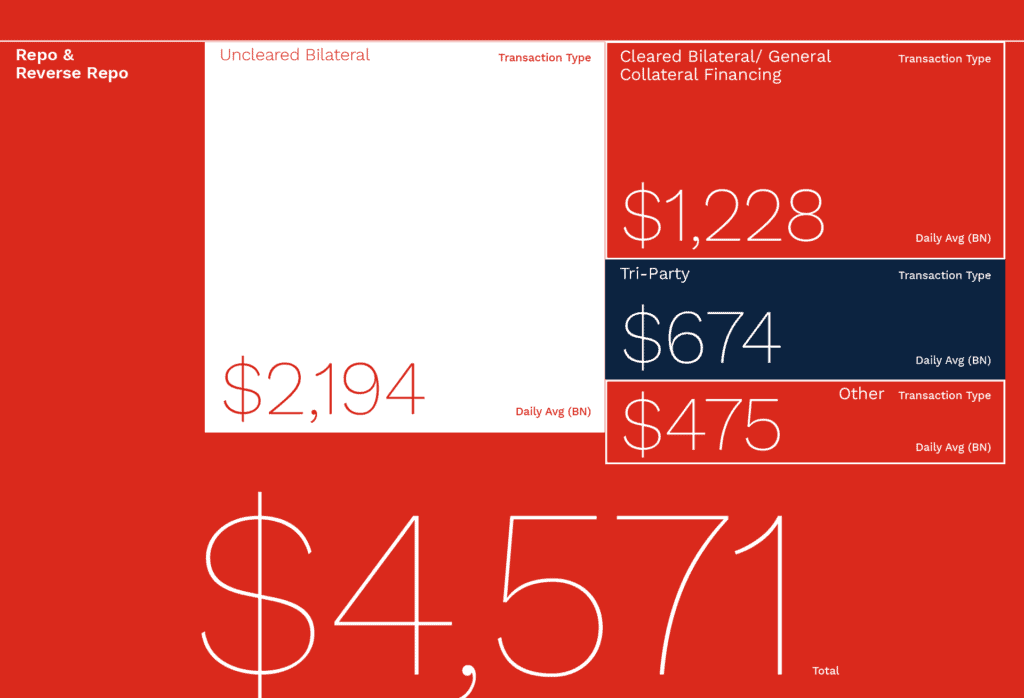

To fully grasp the magnitude of these changes, it’s crucial to understand the scale of the U.S. Treasury market. In 2023:

- Average daily transaction volumes exceeded $700 billion in Treasury cash trades.

- Repo and reverse repo agreements accounted for $4.5 trillion in daily transactions.

- With the implementation of the SEC’s central clearing mandate, total daily activity volumes are projected to surpass $11.5 trillion.

These figures highlight the increasing reliance on repo markets for short-term financing and collateralized lending. The SEC’s move is expected to enhance systemic resilience by reducing settlement risks, a crucial factor during periods of market stress (e.g., March 2020 liquidity crisis).

Currently, the Fixed Income Clearing Corporation (FICC) is the only Central Counterparty (CCP) for U.S. Treasuries. As noted above, the expansion of central clearing to the U.S Treasury market will reduce risk primarily by increasing the amount of trading activity managed through centralized netting and CCP risk management systems with the aim to reduce settlement flows and fails1. Additional key benefits include4:

- Promotes Multilateral Netting – CCPs will be the legal counterparty to both sides of the trade; combining all transactions between multiple parties into a single net position reduces counterparty risk, lowers settlement costs, and enhances liquidity for the participants. Example: Instead of clearing thousands of individual transactions bilaterally, CCPs streamline the process, reducing risk exposure.

- Establishes Robust / Transparent Risk Management – The proposal designates the FICC as counterparty for all U.S. Treasury trades, which enforces standardized margins and settlement processes to boost efficiency and reduce systemic risk. Central clearing and systemic netting of positions lowers margin and capital requirements addressing risks from hybrid Inter-Dealer Broker trades. Why It Matters: The failure of counterparties like Lehman Brothers in 2008 demonstrated the dangers of uncleared bilateral trades.

- Improves Operational Efficiency – Utilizing a CCP streamlines processes and reduces redundancies in the trading workflow. Data Insight: Failed settlements in Treasury markets surged during the COVID-19 crisis, amplifying financial stress.

- Increases Competition – The Treasury market is highly concentrated among major dealers in cash and repo markets. With the upcoming changes, the SEC expects smaller nonbank dealers to enter, which will boost intermediation capacity.

- Enhances Regulatory Visibility – Monitoring CCP activity enhances and reveals insights into Treasury trades, especially hedge fund and Inter-Dealer Broker activity, which are less visible under the current structure.

Immediate Considerations for Market Participants

With the first deadline of March 31st, 2025, fast approaching, market participants must act now to address the immediate considerations and ensure compliance with the SEC’s central clearing mandate for U.S. Treasury transactions. Here are some key immediate considerations to keep in mind6,7:

Assess Eligible Transactions

Market participants must review their transactions to determine if central clearing is required, as the rule covers much of the Treasury market trading but excludes most dealer-client trades, certain repo-like financing transactions, and trades by exempt participants.

Access Clearing

The rule is expected to drive significant demand for access to FICC’s clearing models, with direct members able to clear their own transactions and non-members accessing central clearing indirectly through models like Sponsored Delivery Versus Payment and General Collateral. Evolving practices and pricing respond to the growing use of “done away” trades, which provide clearing services to clients that have executed a trade with a different counterparty.

Risk Management

Market participants should discuss the implications of central clearing—including margining, collateral management, and rule changes that affect sponsors’ ability to collect and post client funds with the Fixed Income Clearing Corporation (FICC). They should also explore optimization strategies, such as bilateral or tri-party arrangements, to streamline processes and enhance collateral and liquidity management.

Change Management

Effectively managing the portfolio of changes, including access, risk, and collateral management, requires a structured approach with significant resource and budget considerations. Prioritizing legal documentation due to lengthy timelines, while industry-wide standardization and institutional system updates, can facilitate central clearing implementation.

How Bip.Monticello Can Help

The SEC’s mandate represents a structural transformation in how Treasury transactions are settled, cleared, and risk-managed, requiring market participants to rapidly adapt their operations, risk frameworks, and compliance strategies.

Bip.Monticello specializes in regulatory advisory, risk management, and operational transformation, equipping financial institutions with tailored solutions to comply with the SEC’s new central clearing requirements.

Our Expertise in Regulatory Compliance & Risk Management

With deep experience in guiding clients through complex regulatory mandates, Bip.Monticello brings a proven track record in:

- FRTB (Fundamental Review of the Trading Book): Helping institutions enhance risk management frameworks by aligning trading activities with capital and liquidity regulations.

- LIBOR Transition: Successfully guiding clients through the discontinuation of LIBOR, ensuring operational and contractual compliance with new risk-free rate benchmarks.

- US QFC (Qualified Financial Contracts) Rules: Implementing strategies to ensure contractual compliance with stay provisions and default risk mitigation.

- UMR (Uncleared Margin Rules) Compliance: Assisting in margin calculation, collateral management optimization, and technology-driven operational efficiencies.

By applying these insights to Treasury central clearing, Bip.Monticello helps firms anticipate compliance risks, enhance trading workflows, and optimize financial resource allocation in the face of new clearing mandates.

Strategic Solutions for U.S. Treasury Central Clearing

The implementation of mandatory central clearing will require a fundamental shift in how institutions manage Treasury transactions, counterparty risks, and liquidity needs. Bip.Monticello provides:

1. End-to-End Clearing Strategy & Compliance Readiness

- Eligibility Assessment – Evaluating transactions to determine which will require mandatory central clearing.

- FICC Membership & Onboarding Support – Assisting firms in the operational, financial, and legal requirements for CCP access.

- Clearing Workflow Optimization – Designing efficient trade processing models to ensure seamless integration with central clearing protocols.

2. Collateral & Margin Optimization

- Risk-Based Collateral Strategies – Assisting firms to identify the most capital-efficient ways to post collateral under new margin requirements.

- Liquidity Impact Assessments – Helping firms to understand the effect of central clearing on liquidity needs and funding costs.

- Technology Integration – Advising firms on exploring different digital solutions for real-time collateral tracking and margin optimization.

3. Operational & Infrastructure Modernization

- Clearing Technology Implementation – Enhancing post-trade infrastructure to align with new settlement cycles and CCP processes.

- Trade and Data Analytics – Leveraging data-driven insights to monitor clearing efficiency and compliance.

- Regulatory Reporting & Documentation – Ensuring that firms meet ongoing disclosure and transparency requirements set by the SEC and the FICC.

Why Partner with Bip.Monticello?

The introduction of mandatory central clearing for U.S. Treasuries is one of the most significant regulatory shifts in decades. Institutions must act swiftly to adapt operations, enhance risk frameworks, and align with clearing mandates. Failure to prepare could lead to liquidity constraints, capital inefficiencies, and compliance risks.

Bip.Monticello’s multi-disciplinary team brings together experts in regulatory strategy, risk management, technology integration, and financial operations to help clients navigate these challenges effectively. By partnering with us, institutions can:

✔ Ensure a smooth transition to central clearing compliance

✔ Mitigate liquidity and margin pressures through advanced optimization strategies

✔ Enhance operational efficiencies by leveraging technology and data-driven insights

✔ Reduce systemic risk exposure and strengthen market competitiveness

Next Steps: Preparing for the March 2025 Deadline

The March 31, 2025 compliance deadline is approaching rapidly. Market participants must take immediate action to:

🔹 Assess their exposure to central clearing requirements

🔹 Develop a robust collateral and liquidity strategy

🔹 Align operational processes with FICC clearing workflows

🔹 Leverage technology to automate margin and collateral management

Bip.Monticello stands ready to provide tailored strategic guidance to ensure your organization remains ahead of the regulatory curve.

📩 Contact us today to schedule a consultation and receive our latest insights on U.S. Treasury Central Clearing.

About Bip.Monticello

Bip.Monticello, a Business Integration Partners S.p.A. company, is a management consulting firm supporting the financial services industry through deep knowledge and expertise in digital transformation, change management, and financial services advisory. We collaborate with our clients to infuse the spirit of data-driven organizations and build digital solutions, helping them make their operations more efficient and achieve a competitive advantage in the marketspace.

Sources

- https://www.aima.org/article/demystifying-the-sec-s-upcoming-treasury-clearing-mandate-and-its-implications-for-market-participants.html#:~:text=The%20United%20States%20Securities%20and,SEC%2Dregulated%20covered%20clearing%20agency.

- SEC.gov | SEC Extends Compliance Dates and Provides Temporary Exemption for Rule Related to Clearing of U.S. Treasury Securities

- What the New Treasury Clearing Timeline Means for Markets – SIFMA – What the New Treasury Clearing Timeline Means for Markets – SIFMA