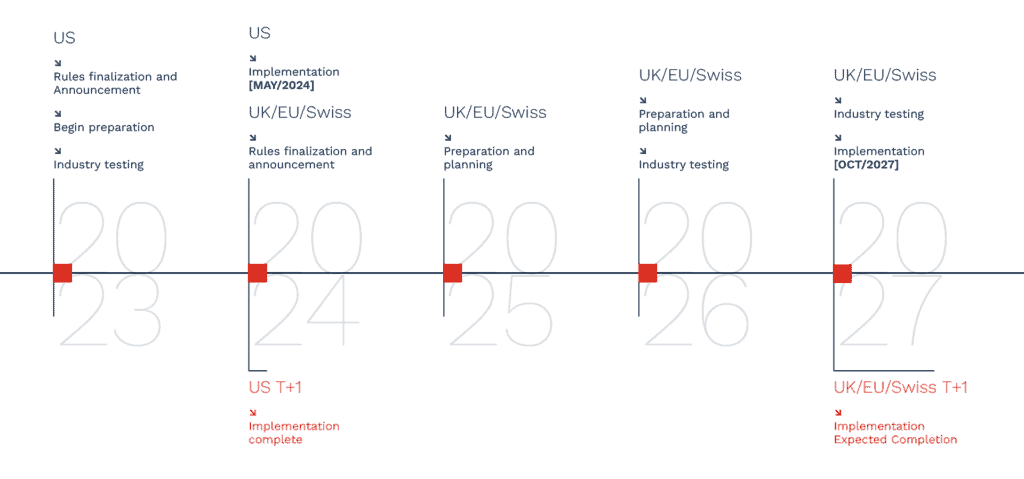

The global financial market is accelerating its shift to T+1 settlement, a move designed to enhance liquidity, reduce counterparty risk, and improve capital efficiency. While the United States has already transitioned to T+1, the UK, EU, and Switzerland have set October 11, 2027, as their deadline for implementation. However, this transition is not without challenges. Market fragmentation, regulatory divergence, and varying levels of automation create significant hurdles for financial institutions. To succeed, firms must invest in real-time processing, streamline operations, and collaborate on cross-border regulatory frameworks. This article explores the key benefits, challenges, and strategic steps necessary for a smooth global T+1 transition.

Benefits of T+1

The primary motivation behind the move to T+1 is the need to reduce pre-settlement risks, such as counterparty defaults, by shortening the time between trade execution and settlement. Several key benefits are associated with T+1:

- Reduction of Counterparty Risk: By reducing the time frame between trade execution and settlement, the risk of defaults due to changes in market conditions or counterparty insolvency is minimized.

- Increased Liquidity: Faster access to funds from transactions enhances market liquidity and promotes a more responsive capital market.

- More Efficient Capital Deployment: The shortened settlement cycle accelerates capital turnover, enabling quicker reinvestment and more agile liquidity management, resulting in improved capital efficiency.

UK, EU, and Switzerland: The Roadmap to T+1 Compliance

Regulatory bodies in the UK, EU, and Switzerland have agreed on a unified transition to T+1, with the final implementation date set for October 11, 2027. This coordinated effort is driven by task forces like the UK’s Accelerated Settlement Taskforce (AST), the European Securities and Markets Authority (ESMA), and Switzerland’s Swiss Securities Post-Trade Council (swissSPTC).

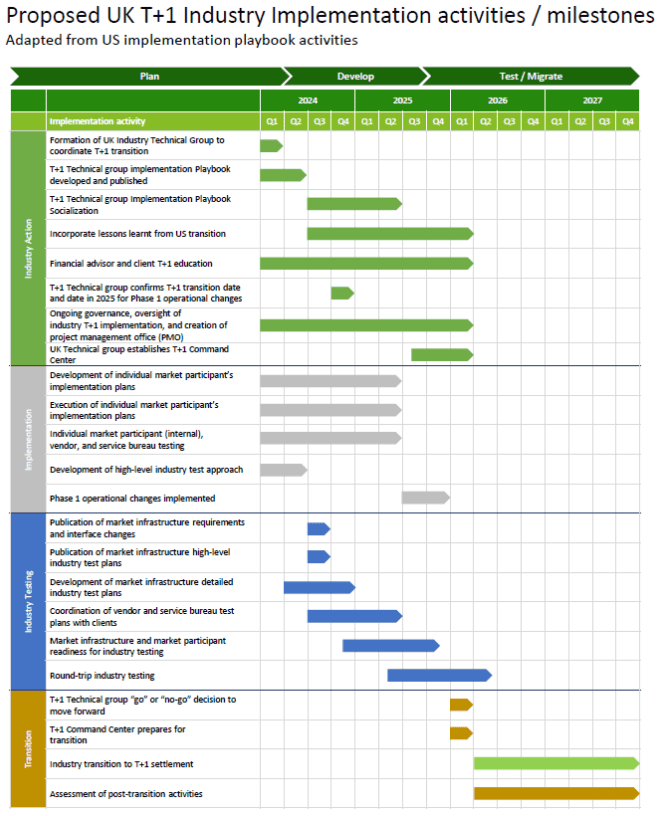

A three-phase strategy has been defined to ensure a smooth transition:

- Phase 1 – Planning (Q3 2025): Defining market-wide strategies, regulatory requirements, and infrastructure needs.

- Phase 2 – Development (Q4 2026): Upgrading settlement systems and implementing automation.

- Phase 3 – Testing & Implementation (2027): Market-wide testing and gradual adoption leading to full migration.

To navigate this shift effectively, market participants must enhance automation, align cross-border operations, and ensure compliance with emerging regulatory frameworks.

Key developments include:

- Governance Frameworks: ESMA, the European Commission, and the European Central Bank (ECB) have developed a governance structure to manage the EU’s shift to T+1. This framework will address operational, regulatory, and technological challenges and facilitate smooth coordination between stakeholders, including regulators, market participants, and infrastructure providers.

- Coordination Among Regulators: A dedicated industry committee will guide the transition, focusing on system upgrades, stakeholder engagement, and regulatory adjustments. The European Commission is also considering legislative changes to enforce the transition.

Challenges and Strategies for the UK, EU, and Switzerland Transition

Despite the coordinated approach, these regions will face several challenges in transitioning to T+1, particularly due to:

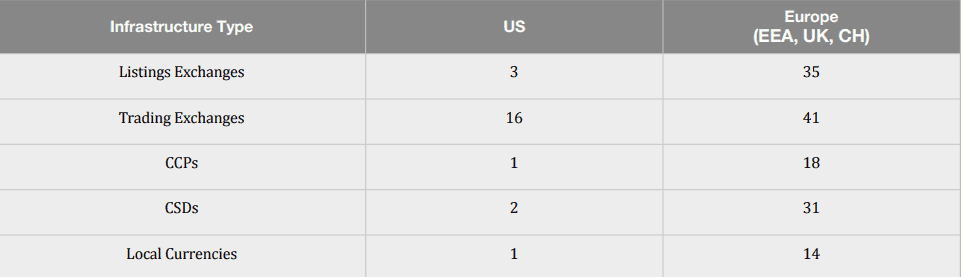

- Market Fragmentation: Europe’s multi-market structure, with different trading, clearing, and settlement systems, poses a challenge to harmonizing post-trade processes.

- Post-Brexit Regulatory Divergence: The UK operates under separate regulations post-Brexit, creating the need to align UK market participants with EU requirements.

- Automation Needs: Significant investments in automation are necessary to streamline processes and mitigate risks. A failure to adopt sufficient automation could lead to settlement fails, especially during the initial transition period.

To address these challenges, market participants must:

- Invest in Infrastructure Upgrades: Market participants should prioritize technological investments and adopt automation solutions, focusing on same-day trade confirmations as best practice.

- Promote Industry Collaboration: Industry-wide cooperation among investors, intermediaries, and custodians is essential to ensure a smooth transition.

- Establish Clear Regulatory Requirements: Clearly defined regulatory frameworks and industry standards are vital for ensuring compliance and minimizing operational risks.

EU Market Fragmentation & T+1 Challenges

Europe’s market fragmentation is a significant hurdle in transitioning to T+1. Unlike single national markets, the EU’s post-trade infrastructure involves multiple markets, each with its own standards, data, and cut-off times. This fragmentation increases complexity and delays in adapting to T+1.

To address market fragmentation and operational challenges, the EU must take decisive actions:

- Establish an Industry Task Force: A cross-industry task force should be created to assess the benefits, costs, and challenges of the T+1 transition. This group should include Central Securities Depositories (CSDs), Central Counterparties (CCPs), buy-side firms, brokers, custodians, and central banks.

- Foster Open Dialogue: Stakeholders must engage in open discussions on how to achieve T+1 and adapt operational and regulatory frameworks.

- Promote Harmonization: Efforts toward operational and regulatory harmonization will simplify the landscape and facilitate smoother adoption of new standards.

- Increase Automation and Reduce Exceptions: Automation of the trade lifecycle and the reduction of exceptions will be essential to ensuring timely and error-free settlements.

- Enhance Standardization: Standardizing processes, data, and cut-off times across CSDs will lead to more interoperability across the EU’s diverse market infrastructures.

T+1 Adoption in APAC: Unique Challenges and Key Strategies

The Asia-Pacific (APAC) region, consisting of diverse markets with varying levels of maturity, presents distinct challenges for T+1 adoption. Some markets, like Japan and Australia, have more advanced infrastructure, while others may struggle with less-developed systems. The high volume of cross-border trading and time zone differences also complicates the transition.

To overcome these challenges, APAC firms can:

- Adopt Follow-the-Sun Models: This approach will help manage settlements across time zones, ensuring timely support during out-of-hours periods.

- Invest in Technology: Significant investments in technology and straight-through processing (STP) solutions will help streamline post-trade activities and support the transition.

- Create Global Teams: Cross-border teams will be essential to coordinate settlements across different time zones and jurisdictions, ensuring operational efficiency.

A structured T+1 migration strategy will help APAC markets align with global standards while addressing region-specific complexities.

Lessons from the US T+1 Transition

The US transition to T+1 in May 2024 serves as a blueprint for other regions, providing valuable insights into automation, operational efficiency, and risk mitigation: Observing the US experience offers the opportunity to learn from both the successes and challenges faced during the transition:

- Automation Best Practices: The US transition highlighted the importance of automating post-trade processes to reduce manual errors and increase operational efficiency. Regions outside the US can adopt similar strategies for automation in trade matching, allocation, and settlement instructions.

- Optimizing Operational Processes: The US experience has shown the importance of reviewing internal operational processes to meet T+1 deadlines. Areas like trade matching, confirmation, and settlement instructions require particular attention.

- Risk Identification and Mitigation: Developing comprehensive implementation plans, identifying potential risks, and refining transition strategies will be critical to ensuring success.

- Understanding Market Impact: The US experience has highlighted the potential impact on FX markets, securities lending, and the risk of increased settlement fails, helping to prepare for these challenges during the initial migration.

T+1 Risks, Issues, and Ongoing Work in the US

Post-T+1 Implementation: Challenges in the US Market

While the US successfully transitioned to T+1, operational hurdles and liquidity concerns persist, including:

- Funding and Liquidity: The shortened settlement cycle has created challenges in securing funding, particularly for firms that struggle to mobilize cash quickly.

- Securities Lending: The reduction in securities lending supply has caused delays and complications in the trading process.

- Operational Challenges: Increased volumes of manual processing and exception handling have placed significant pressure on sell-side firms.

- Time Zone Differences: The reduced funding window due to time zone differences has increased operational risks, particularly in Europe and APAC.

Even after the official transition, a significant portion of the work continues, including further automation efforts and process optimizations.

Preparing for the T+1 Transition in 2027: Key Steps for Success

To prepare for the T+1 transition in 2027, the UK, EU, Switzerland, and APAC regions should take several key actions based on the lessons learned from the US transition:

- Engage Stakeholders: Open communication among market participants, regulators, and infrastructure providers is vital to ensure alignment and cooperation.

- Establish Clear Timelines and Roadmaps: Detailed plans with clear timelines and milestones should be developed for each region, focusing on key activities such as system upgrades, process optimization, and regulatory compliance.

- Prioritize Automation: Investment in technology, automation, and real-time solutions will be essential for meeting the new settlement timelines.

- Harmonize Market Practices: Standardizing settlement instructions, trade matching, and allocation processes will improve efficiency across fragmented markets.

- Address FX Challenges: Firms should adjust FX processes and cut-off times to ensure transactions are completed on time and consider using third-party providers for pre-funding transactions.

- Optimize Operational Processes: Firms need to identify and resolve inefficiencies in their current processes to ensure readiness for T+1.

- Learn from the US Experience: The UK, EU, Switzerland, and APAC regions should carefully analyze the US transition to incorporate best practices and mitigate potential challenges.

How Can BIP US Support Your T+1 Transition?

At BIP US, we provide expert guidance to financial institutions preparing for T+1 settlement across the UK, EU, Switzerland, and APAC. Our specialized services include:

- Strategic Planning: Creating detailed roadmaps, setting clear timelines, and coordinating milestones for each region.

- Process Optimization: Analyzing and streamlining post-trade processes to eliminate bottlenecks and inefficiencies.

- Technology and Infrastructure Upgrades: Assessing current systems and recommending necessary upgrades to support automation and real-time processing.

- Risk Management: Identifying and mitigating risks related to T+1, such as settlement fails and counterparty risk.

- Change Management: Guiding organizations through the process of adapting to new workflows and processes.

- Regulatory Compliance: Ensuring that firms comply with new regulations related to T+1 and settlement discipline frameworks.

- Stakeholder Coordination: Facilitating communication between market participants, regulators, and infrastructure providers to ensure alignment and cooperation.

The successful transition to T+1 requires a comprehensive approach that incorporates technology, process optimization, and close collaboration among all stakeholders. By taking proactive steps, market participants can ensure a smooth and effective transition by the 2027 deadline.

Are you ready for T+1? Contact BIP US today to develop a tailored strategy and ensure a smooth transition by 2027.

Sources: